extended child tax credit portal

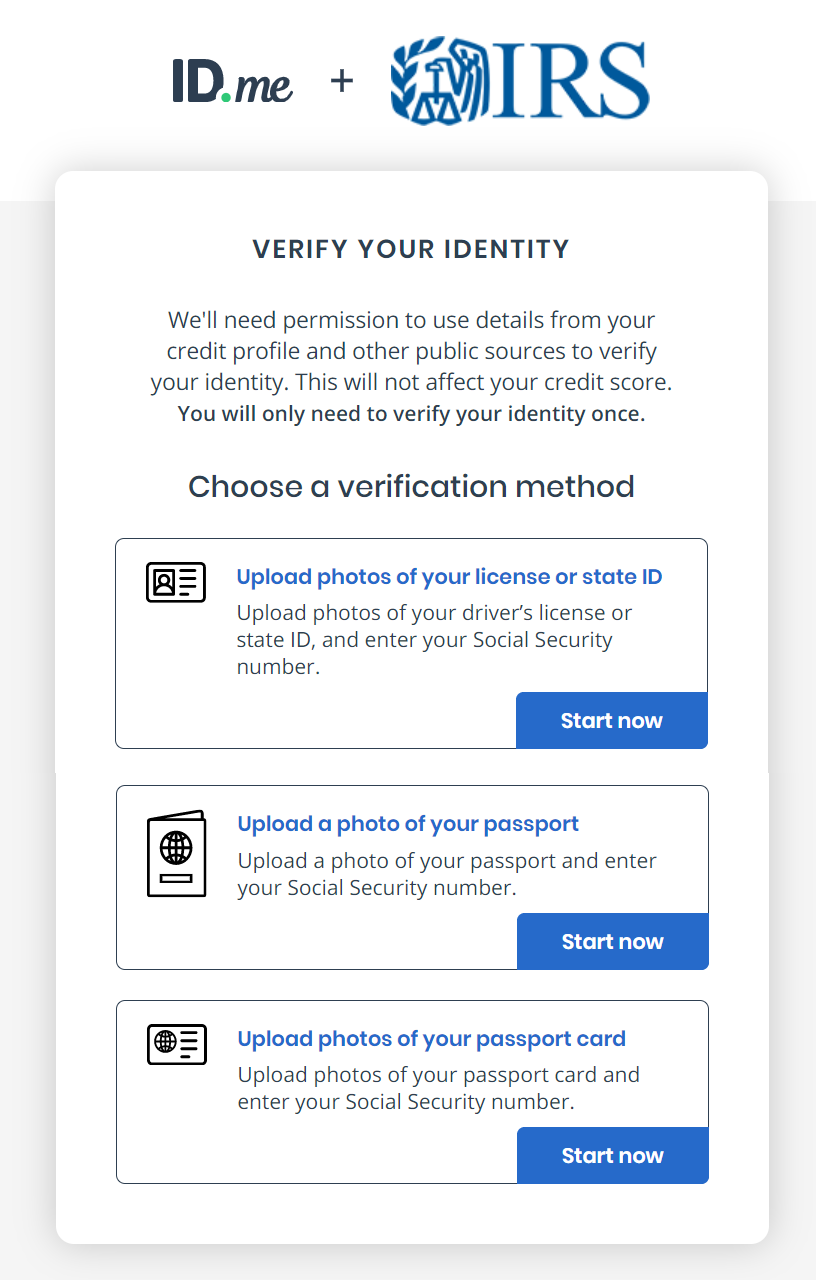

THE IRS has launched child tax credit online portals that will help parents to get the extra stimulus money when the monthly 300 payments begin on July 15. In a recently published article of The US Sun the child tax credit in December marked its final month for the expanded child tax credits where families.

![]()

Child Tax Credit Update Irs Launches Two Online Portals

Child tax credit payments set to go out Monday.

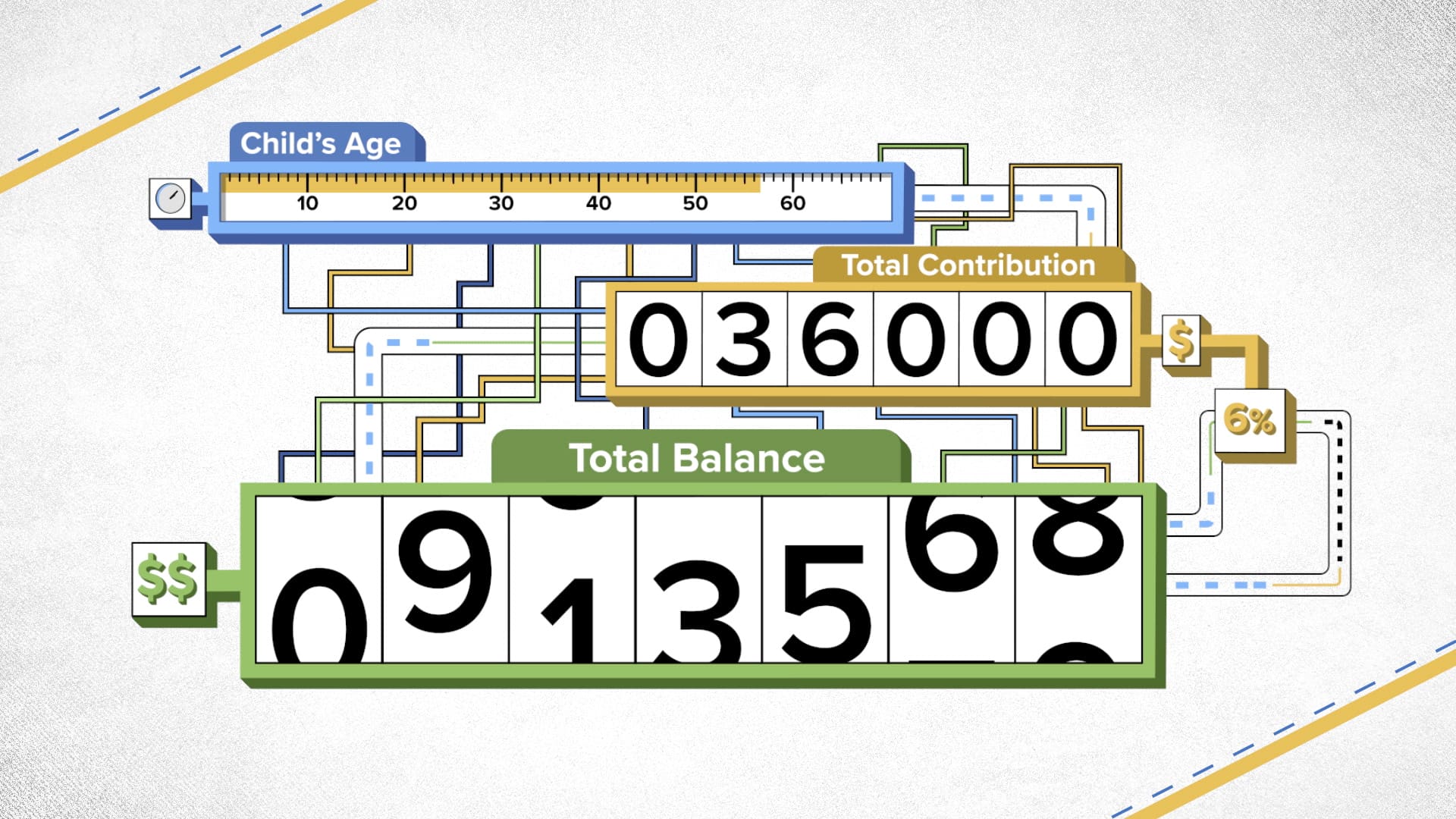

. 3600 for each child under age 6 and 3000 for each child ages 6 to 17. Could be next-to-last unless Congress acts. Specifically the Child Tax Credit was revised in the following ways for 2021.

The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children. Because the enhanced child tax credit was not extended by lawmakers millions of taxpaying American parents will see the federal credit revert back to 2000 per child this year. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600.

Generally you can expect to receive up to 300 per qualifying child under age 6 and 250 per child ages 6 to 17. Child tax credit payments set to go out Monday. The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021.

That legislation has since stalled. The American Rescue Plan signed into law by President Biden expanded the Child Tax Credit for 2021 to get more help to more families. The Child Tax Credit.

The American Rescue Plan. Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. Increased the credit from.

The credit amount was increased for 2021. Havent Received a Child Tax Credit. The expanded Child Tax Credit that was part of the American Rescue Plan legislation passed by Democrats in Congress and signed by President Biden in March has not.

You can use your username and password for. The American Rescue Plan increased the amount of the Child Tax. The fourth installment of this years Advance Child Tax Credit is set to hit bank accounts today Fri Oct.

It could be extended through 2022 under Democrats 175 trillion social. Most families will receive the full amount. The maximum child tax credit amount will decrease in 2022.

If you are already receiving the maximum amount a decrease. To get money to families sooner the IRS is sending families. But others are still.

It could be extended through 2022 under Democrats 175 trillion social. Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens 35 trillion plan. Could be next-to-last unless Congress acts.

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of.

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Fourth Child Tax Credit Payment Goes Out This Week What Parents Need To Know Fox Business

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

2021 Child Tax Credit Advance Payments Claim Advctc

Time Is Running Out To Sign Up For Monthly Child Tax Credit Payments

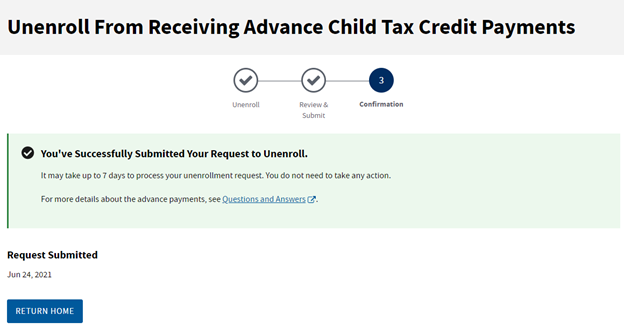

Child Tax Credit Update Irs Launches Two Online Portals

Last Day To Unenroll In July Advanced Child Tax Credit Payment

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Who S Not Eligible For Child Tax Credit Payments It May Explain Why You Re Not Getting Them Kiplinger

Usa Finance And Payments Gas Stimulus Check Tax Deadline Child Tax Credit Portal 4 April As Usa

Child Tax Credit Update A Portal To Update Bank Details And Facilitate Payments Marca

Child Tax Credit Payments From Irs For 2021 Starting

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

The Child Tax Credit The White House

Child Tax Credit 2022 Payments Of 750 Available For Americans See If You Have The Qualifications To Apply The Us Sun

Child Tax Credit Irs To Open Portals On July 1 Checks Will Begin July 15 Where S My Refund Tax News Information